in

How much do I need to refund to my CPF account if I am selling my whole property?

cpf

Source: https://www.cpf.gov.sg/memberIf you are selling your property, you will need to refund the CPF principal amount withdrawn plus the accrued interest ("P+I").

If you have reached 55 and have pledged the property to make up your retirement sum, you will need to refund the pledged amount on top of the P+I. The amount refunded will be used to top up your Retirement Account, up to your Full Retirement Sum. After this, any balance housing refunds will be paid to you in cash.

If the selling price (including the option monies) after paying the outstanding housing loan is not enough to fully refund your required CPF refund, you do not need to top up the shortfall in cash, provided that the property is sold at market value. However, the option monies (e.g. option fee and option exercise fee) received from your buyer in cash upon the sale of your property are considered part of the selling price and need to be refunded to your co-owner's and your CPF accounts before the transaction can be completed.

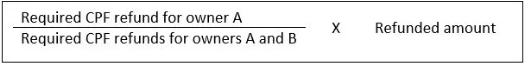

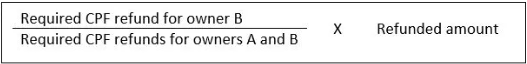

The refunded amount will be returned to your co-owner's and your CPF accounts in the following proportions:

Amount returned to owner A's CPF Account:

Amount returned to owner B's CPF Account:

This information provided here is sourced from the CPF website.

Can’t find what you’re looking for?